Liquidity through Designated Sponsors

Liquidity through Designated Sponsors

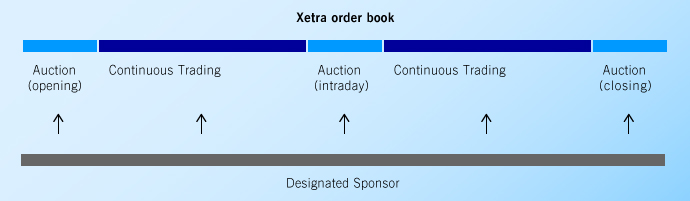

Designated Sponsors are market participants who post binding buy and sell offers for the trading of less liquid securities. There can be one or several Designated Sponsors per security. The trading participant submits an application to be admitted as a Designated Sponsor on Xetra® to the Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange).

With regard to the provision of liquidity, Designated Sponsors are subject to high quality criteria (minimum requirements). By way of example, when quoting Designated Sponsors must observe a maximum spread (between the buy and sell price) and a minimum quote volume (minimum lot size which must be posted on both sides of the order book). Furthermore, they are obliged to adhere to a minimum quotation duration. Due to their quotation activity, Designated Sponsors are in principle also subject to the applicable rules for Regulated Market Makers under MiFID II / MiFIR.

Further information

Contact

Designated Sponsor Program

Cash Market Business Development