Focus: ESG

ESG – the capital markets’ responsibility for sustainable investments

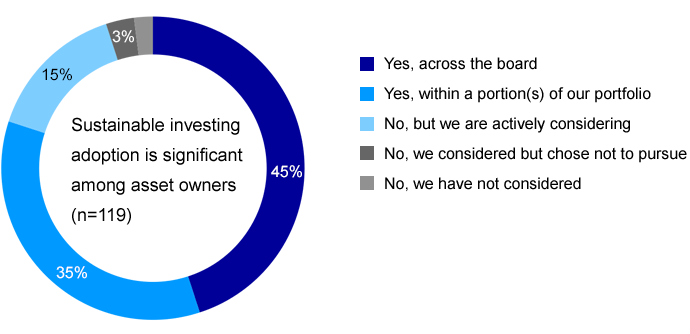

The term ESG has been established as a mainstream standard for sustainable investing. Most investors – private and institutional – want their investments to impact the world positively:

My investments should have a positive impact on the world

Source: Deutsche Bank AG, CIO Special, ESG Survey 2022 - Trends and concerns

A study published by consulting firm PwC in 2022, which surveyed 250 asset managers and 250 institutional investors, shows the exponential speed of the shift towards sustainability in investment choices. According to the study, close to 84 per cent of institutional investors in Europe plan to expand their sustainable investments. And sustainability does not come at the expense of returns: the report shows that a majority of investors (60 per cent) already achieve higher returns with their ESG investments compared to non-sustainable investments, while another quarter (25 per cent) report consistent returns. The study also indicates that a lack of suitable investment strategies can have serious consequences for asset managers. Almost 90 per cent of institutional investors have either already terminated their collaboration with individual asset managers due to a lack of ESG strategies or are considering doing so.

Developing new products is essential for asset managers to remain competitive. In terms of investors’ thematic focuses, demand for products which include considerations of water supply and climate protection remains consistently high, as shown in a Morgan Stanley study from 2022 (“Sustainable Signals, Opportunities for Asset Managers to meet Asset Owner demands”). Topics such as community development and education are also among the prioritised investment themes.

Deutsche Börse aims to promote this change. At the end of 2022, of the more than 2,000 exchange-traded index funds, over 730 ETFs already had a focus on sustainability criteria such as ESG or SRI (Socially Responsible Investing). With this selection and an average monthly trading volume of around €16 billion, Xetra® is the leading trading venue for ETFs in Europe. More than 60 per cent of its order volume is international, which makes Xetra an attractive trading platform not only for listings, but also for investors.