Market briefing: ''November was a very strong month at Eurex Repo across all markets''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

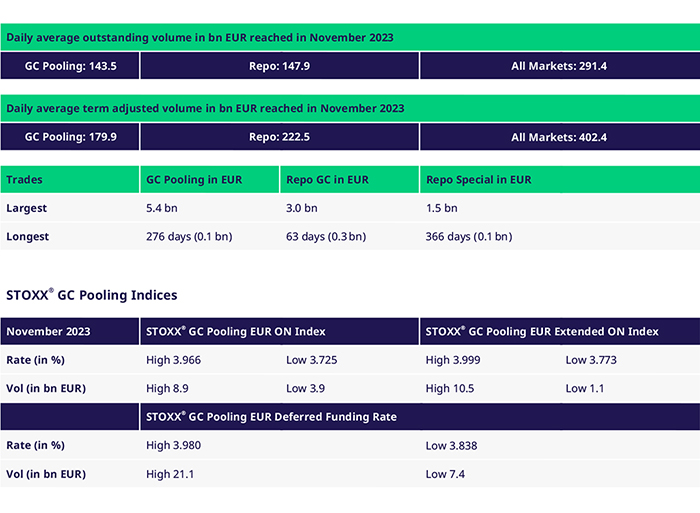

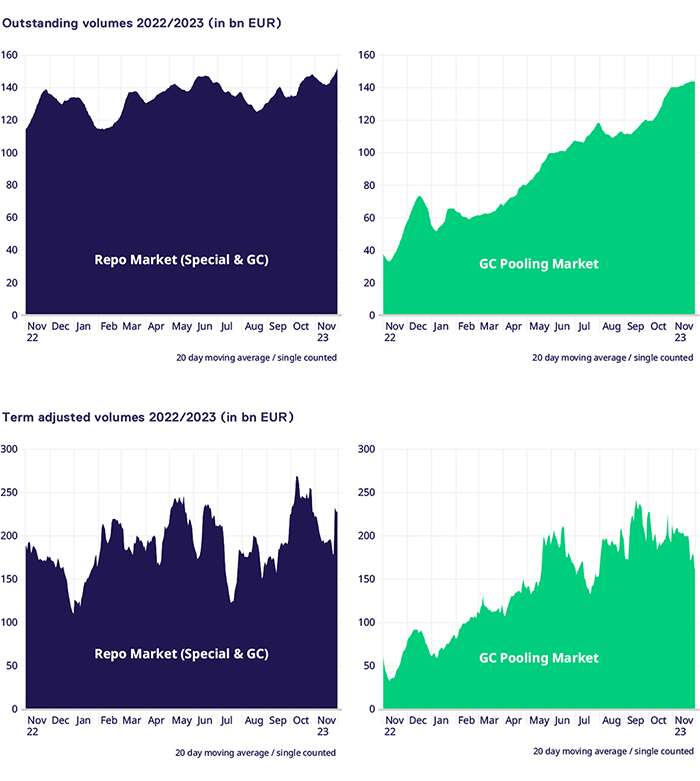

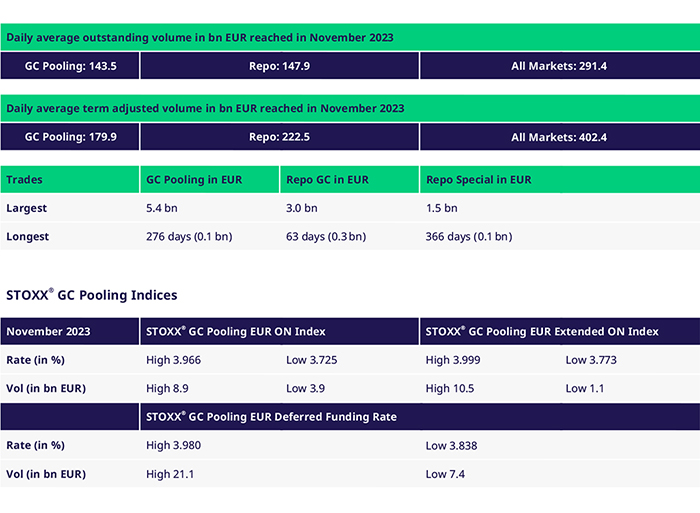

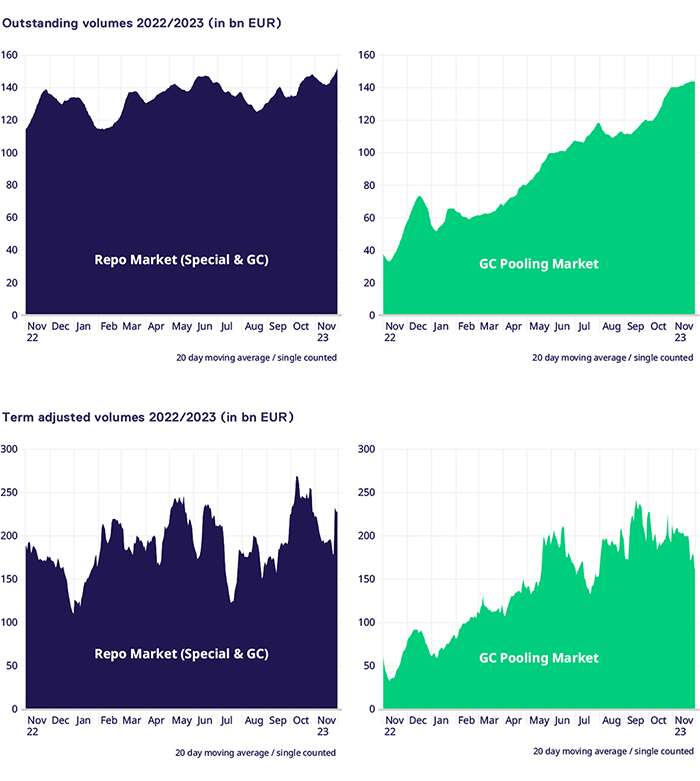

Even though the major central banks paused further rate decisions in November, the month continued to be a very strong at Eurex Repo across all markets in term-adjusted volumes. Overall, an impressive 70% growth to €361bn across all markets was reached compared to the same period last year. Average traded volumes almost doubled compared to the same period last year (Year-to-date) with a strong increase of 230% in GC Pooling volumes and 30% in the GC & Special Repo. The market continued to roll positions in the GC & Special Repo market over year-end.

Outstanding Volumes

Average outstanding volumes continued to be robust with a year-to-date increase of 125% for the GC Pooling market and a 40% increase for the GC & Special markets.

Spreads and Collateral

The average spread between GC Pooling EXT and the ECB Basket stayed stable at around 3bps. Remarkable, both baskets (ECB and ECB EXT) moved slightly closer to the 4% Deposit rate during the month of November. The average spread between ECB EXT basket traded up to €STR plus 8-9bp.

Government Bonds

Trading volumes in the Bund Special repo market saw a decrease in November compared to the same period last year, mainly due to lesser scarcity and expectations of a steady year-end in the market. Nonetheless, looking at the year-to-date figures, there has been an overall increase of 6% in Bund special trading volumes.

EU Bonds/SSAs

EU bonds continued to be traded at a high level and were slightly above the level of November last year (+3%). Overall, the EU bond repo volumes increased year-to-date by 83%.

January – November average monthly traded volume in Supranationals & Agencies increased by 31% compared to 2022, due to the strong increase in EU bonds.

Eurex – Home of Term Repo

The average term-adjusted volumes in GC Pooling reached a strong year-to-date growth of 145%, while GC & Special term business increased by 36%.

We see continued business in standard terms in GC Pooling up to 12 months.

As a result of these activities, a new record in daily term-adjusted volume of €1.53 trillion was set on 28 November.

Year-end activity commenced in Special Repo with volumes traded in Government Bonds, primarily in Bunds, French and Spanish bonds. The majority of trades will mature in January/February 2024.

Did you know?

Eurex Repo has introduced a new Break Date order type to simplify and standardize month/quarter/year-end trading. Enter an order as a Quote/RfQ or Pre-arranged and automatically generate trades optimized for month/quarter/year-end trading. Get ready for year-end and contact us now!”

"Eurex Repo's new break date order types help to establish standardized netting dates to simplify balance sheet netting in Europe"

Greg Morton, UK & EMEA Repo Trading, UBS

In addition, Eurex Repo made available a repo balance sheet netting monitor providing members with visibility of their net cash position across their centrally cleared specific ISIN and GC Pooling repos directly on our F7 trading system.

“We have seen significant client activity over the past year on certain settlement dates as clients were looking to manage their balance sheet more efficiently. Our Balance Sheet netting monitor and Break Trade order types were specifically designed to increase transparency, improve efficiency and enhance liquidity”

Frank Odendall, Head of Securities Financing Product & Business Development, Eurex

Video series

Trading on Eurex Repo in a Changing Interest Rate Environment: New Times Call for New Strategies

Changing interest rates in the Eurozone have created new trading dynamics on Eurex Repo. Some traders are seeing positive interest rates for the first time in their careers, leading to questions about trading strategies, risk management and how to best access Eurex Repo as buy-side clients and relative to bilateral options. To help traders understand new opportunities, Eurex has created a series of training videos on repo in a changing interest rate environment.

GFF podcast series - stay connected

The Global Funding and Financing (GFF) podcast is Clearstream’s podcast series for the funding and financing industry, releasing monthly episodes with senior leaders in the space of secured finance covering all major topics shaping the world of collateral, securities lending, repo and OTC derivatives leading.

Topics:

Year-end Special: Repo Markets, Excess Liquidity, ECB policy & Predictions for 2024 Year-End Special: Repo Markets, Excess Liquidity, ECB policy & Predictions for 2024

Speakers include:

Martin Nazary, Trader at Federal Republik of Germany Finance Agency

Christoph Rieger, Head of Rates & Credit Research, Commerzbank

Listen now

Industry events

Save the date: GFF Summit 2024 | 30 January - 1 February

We are thrilled to announce that the Global Funding and Financing (GFF) Summit will be back on 30 January to 1 February 2024 in the European Convention Center in Luxembourg.

Interested in joining? We will inform you as soon as registration opens, but make sure to save the date and mark your calendar already today.

Can’t wait? Follow #GFFSummit on LinkedIn to stay up to date and to have a look at our past events or tune in to the GFF podcast, available on all your favorite streaming platforms.

We look forward to seeing you in Luxembourg!

Volumes

Participants

View the current Participant List Repo and GC Pooling.

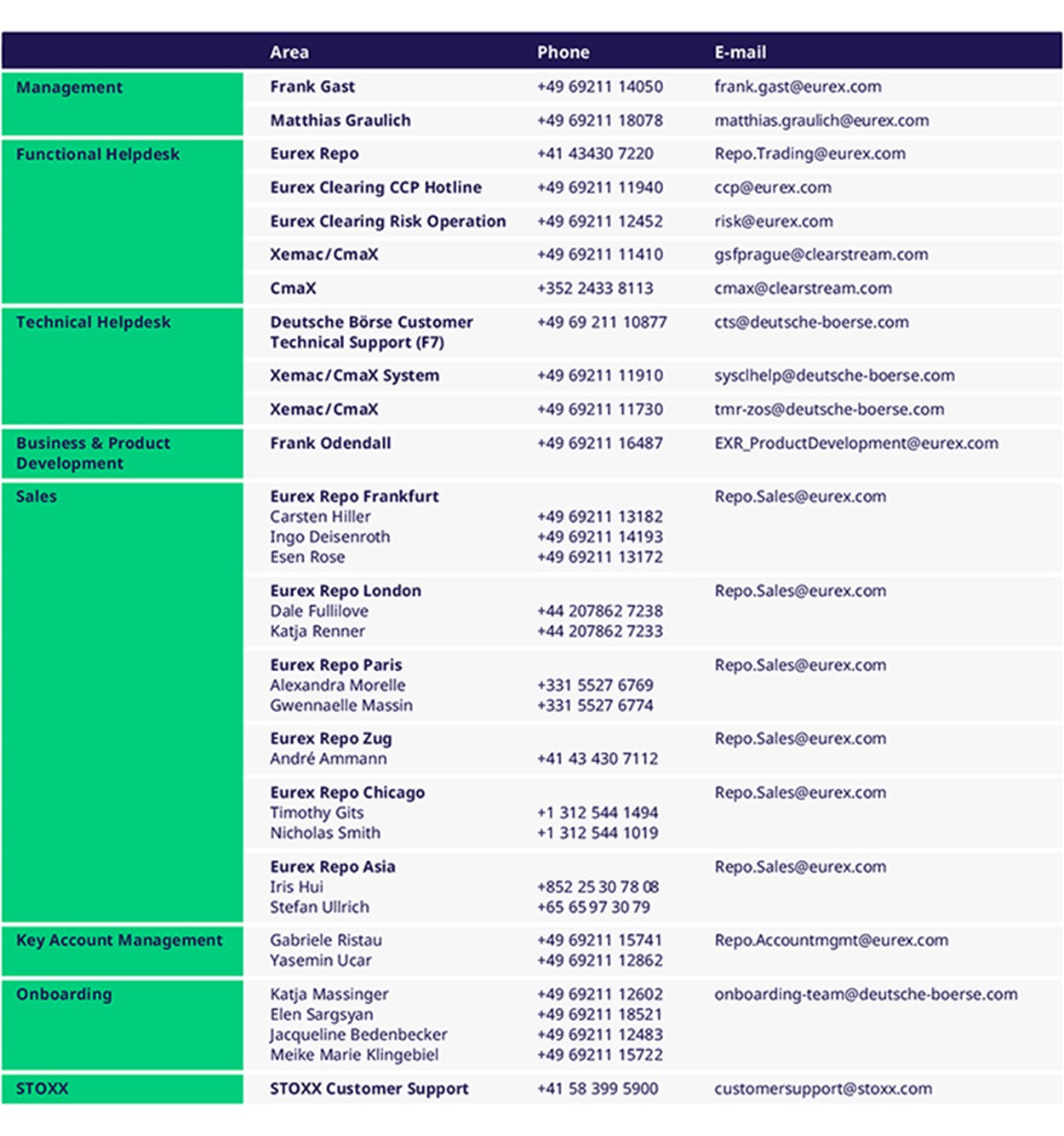

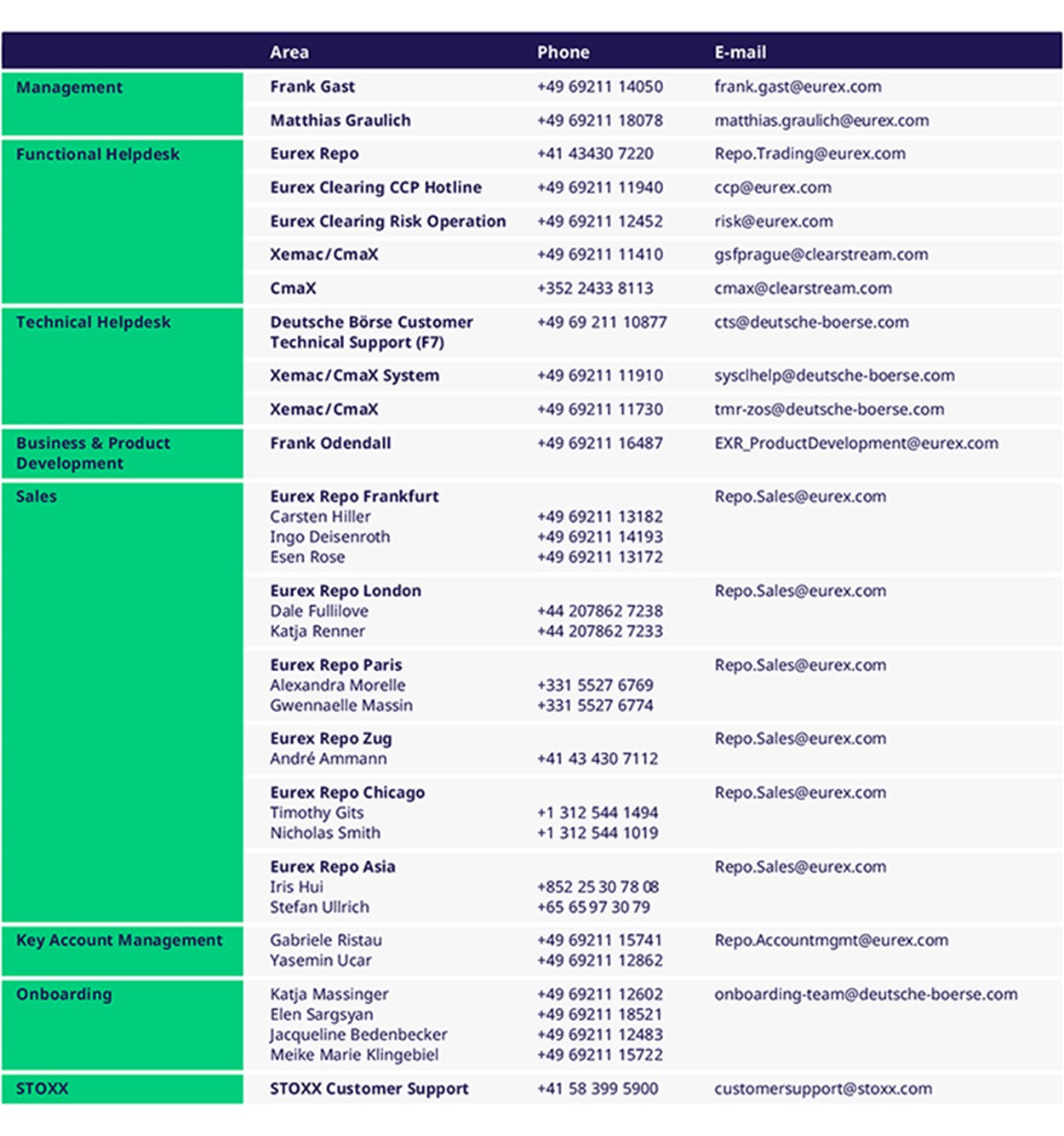

Contacts

For more information, please visit the websites of Eurex Repo and GC-pooling or contact: