Market briefing: ''Remarkable upswing in March 2024''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

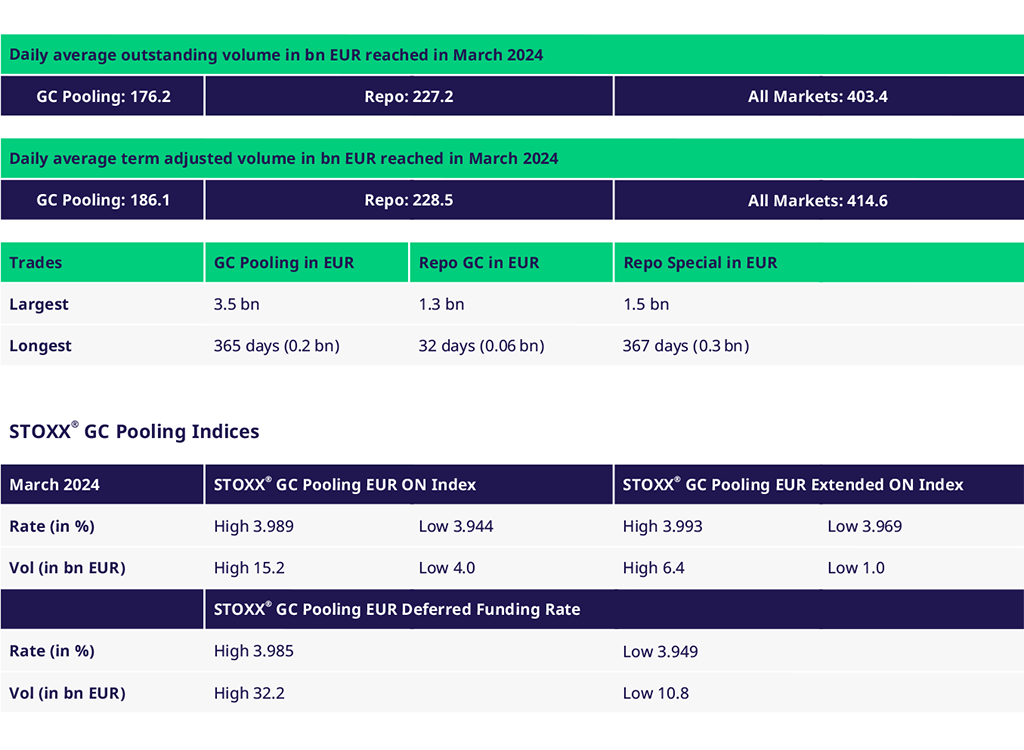

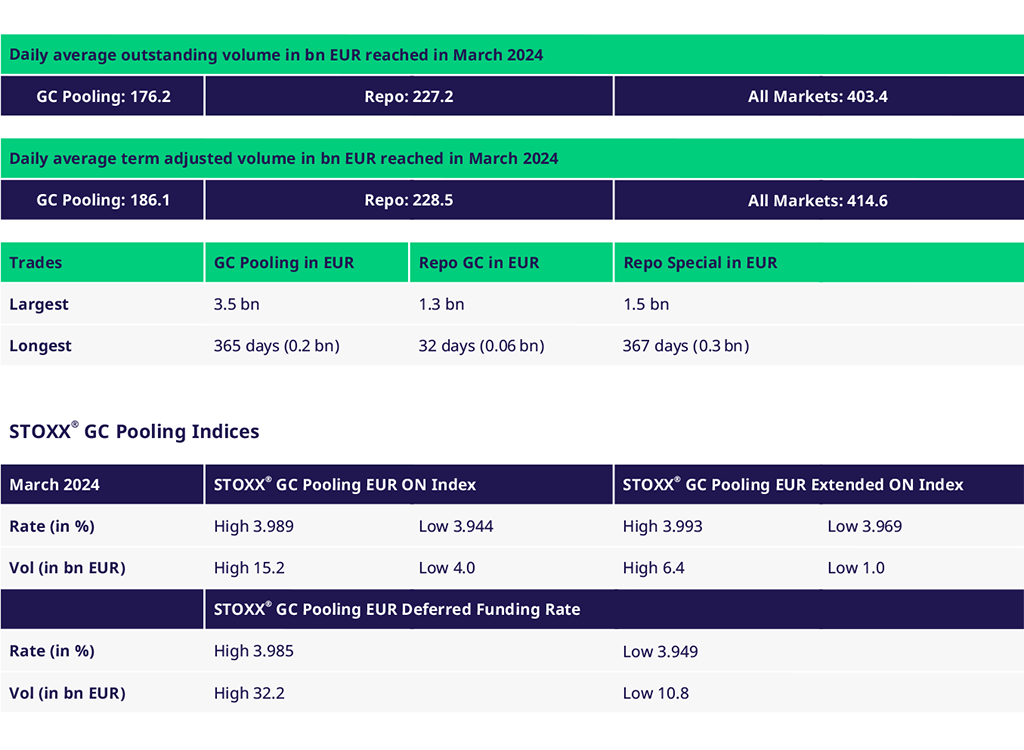

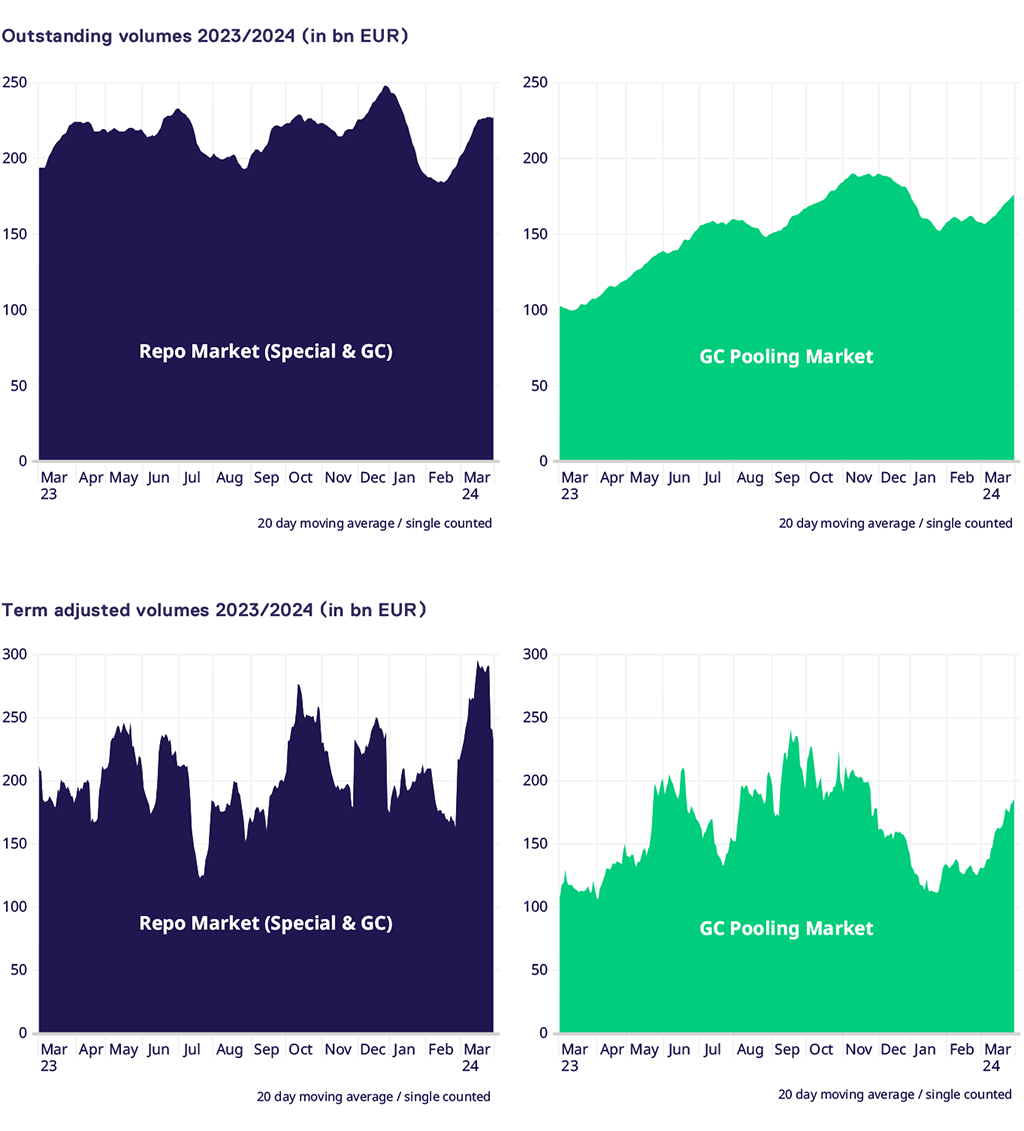

Eurex Repo experienced a remarkable upswing in March 2024 and recorded a strong increase in volumes in the various segments. The average term-adjusted volume rose to an impressive €414.6bn. This growth was led by significant activity in the GC Pooling segment and the Repo segment with volumes of €186.1bn and €228.5bn respectively. This dynamic development corresponds to a significant increase of 36.1% compared to the corresponding period in March 2023.

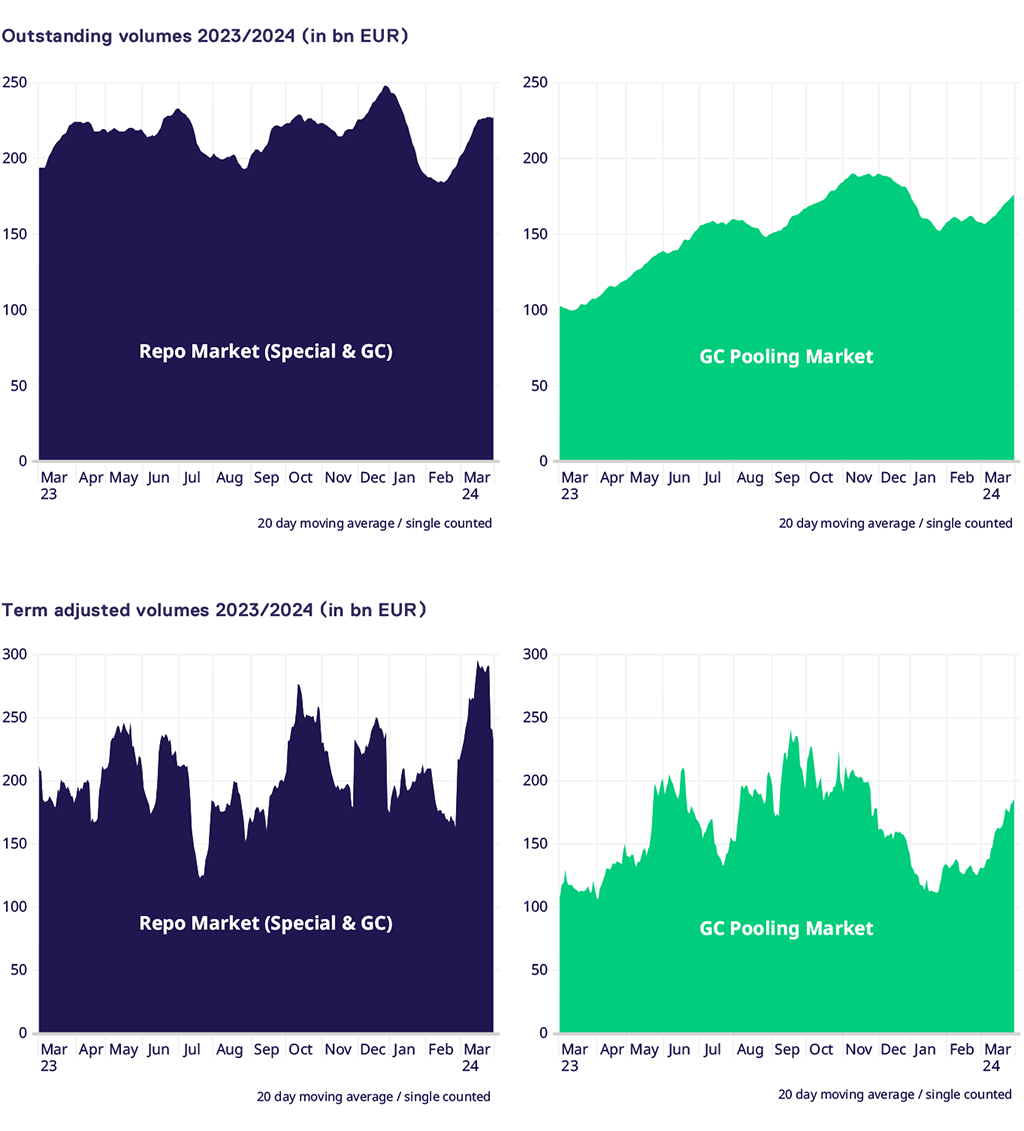

Outstanding and Traded Volumes

Year-on-year, the average outstanding volume across all market segments rose by 22%. This increase is primarily driven by GC Pooling, which recorded remarkable growth of 62.4%. Specials & GC Repo, on the other hand, showed slight growth of 1.8%. In addition, the average trading volume of Eurex Repo increased by 3.7% in March 2024 compared to March 2023, indicating a stable and positive market development.

Spreads and Collateral

On average, we observed a narrowing of the spread between the GC Pooling EXT and the GC Pooling ECB basket of approx. 1.50 basis points. The average spread of these two GC Pooling baskets against the €STR (ECB 5.9bps; EXT 7.4bps) and the deposit rate (ECB -3.4bps; EXT -1. 92bps) widened slightly compared to February.

Bund special repos remain quite cheap with an average rate in the short-term bucket (up to 1 week) of 3.82%.

The end of the quarter with the long Easter weekend was more or less a "non-event" with overnight GC Pooling at 3.966% (ECB basket) and 3.99% (EXT basket). Bunds also traded only slightly lower at 3.74%.

Eurex Term Repo

Term-adjusted volumes in GC Pooling rose by 44% compared to February, which is primarily due to the extensive term business in the ECB basket, particularly with terms of 6, 9 and 12 months. Special repo transactions also recorded growth of 7% compared to February, with significant business in Italian, Spanish and French government bonds as well as EU bonds with tenors of 1 to 3 months. Particularly noteworthy is the significant volume traded in French and German government bonds with a term of 12 months.

Government Bonds

As demand for German government bonds in special repo transactions continued to decline, the traded volume fell by 32% year-on-year due to market conditions. However, as average trading volumes in Special & GC fell only slightly by 2.7%, this reflects the strong growth in other EUR government bonds, with Spanish government bonds rising by 105%, Italian bonds by 162% and French bonds by as much as 174%. The strong growth in EUR government bonds is not only due to the good term business, but also to the higher quoting activity of various customers in the order book.

EU Bonds and SSAs

Traded volume in Supranationals & Agencies decreased YTD by 28%, whereas volumes recovered in March by 42% compared to February. EU bonds traded volumes increased by 14% compared to March 2023.

Events - save the date

Eurex Repo update roundtables:

📍 Milan, 14 May

📍 Paris, 15 May

📍 Brussels, 21 May

Video series

Changing interest rates in the Eurozone have created new trading dynamics. Questions arise about trading strategies, risk management and how to best access Eurex Repo as buy-side client. To help traders, Eurex has created a series of training videos on repo in a changing interest rate environment.

Volumes

Participants

We welcome the following new clients who have been admitted to Eurex Repo in March 2024:

• BNY Mellon NV/SA, Brussels (GC Pooling)

• Kepler Cheverux, Paris

View the current Participant List Repo and GC Pooling.

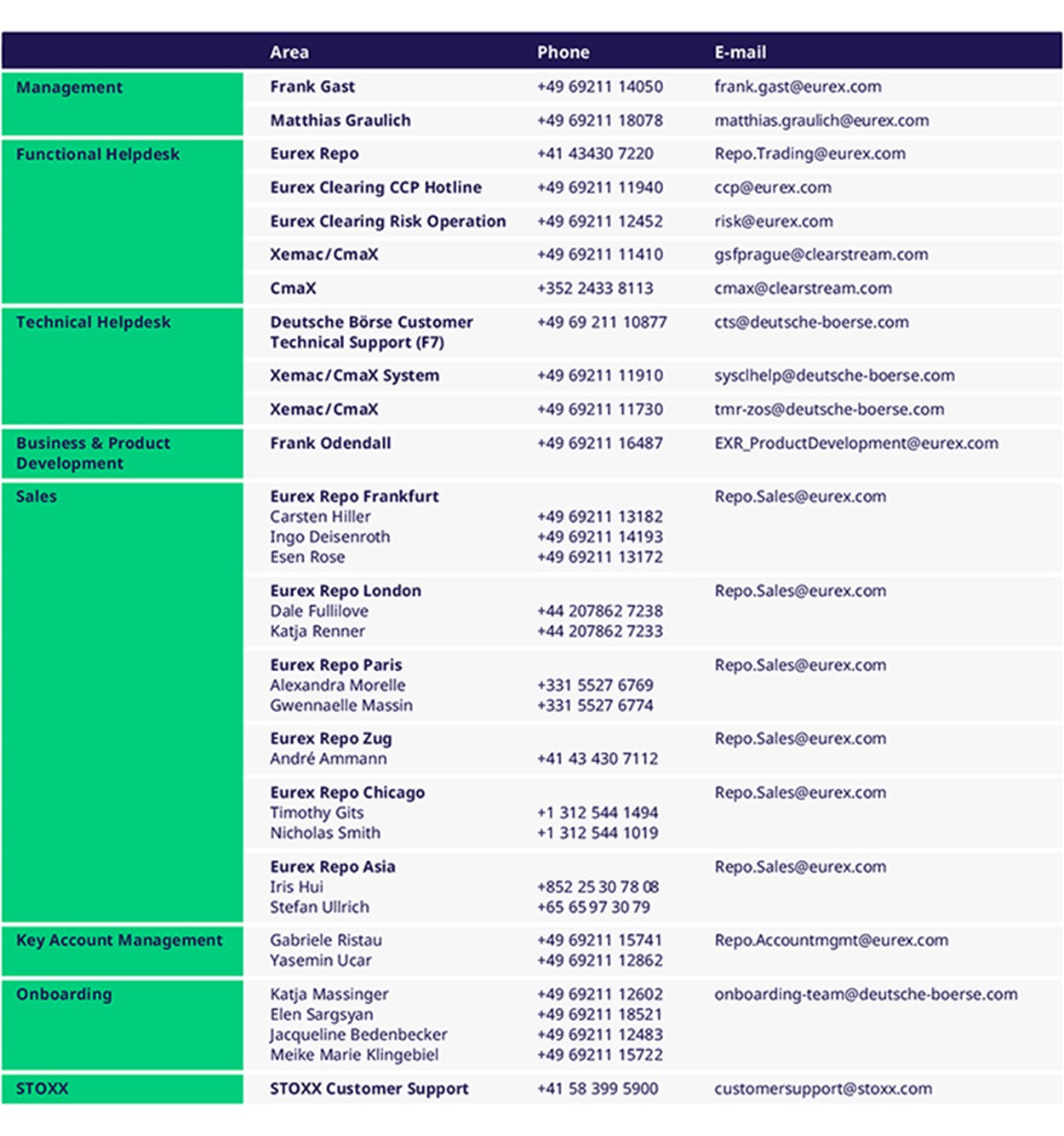

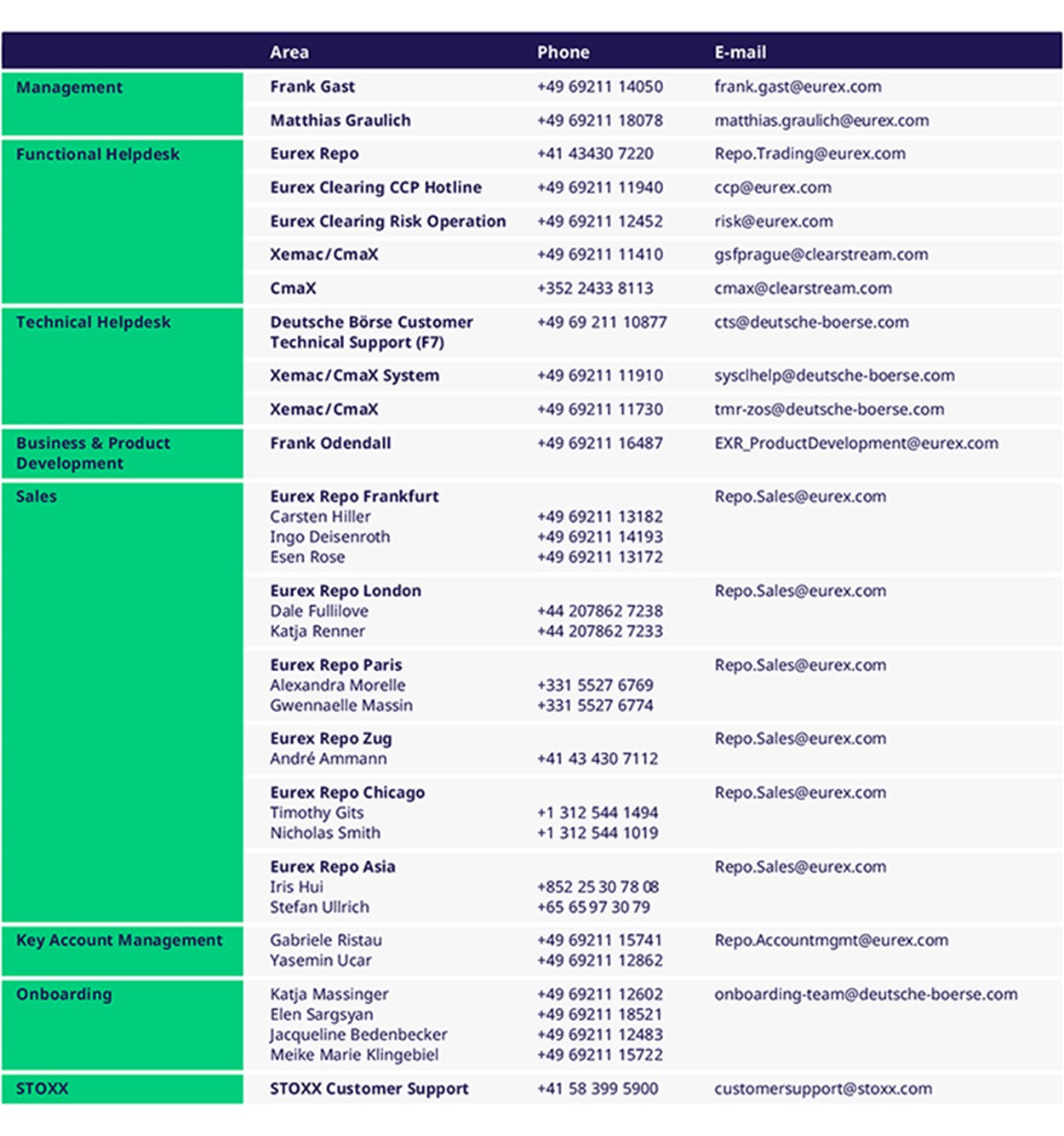

Services & Contacts