Market briefing: ''Consistent upward trend continues''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

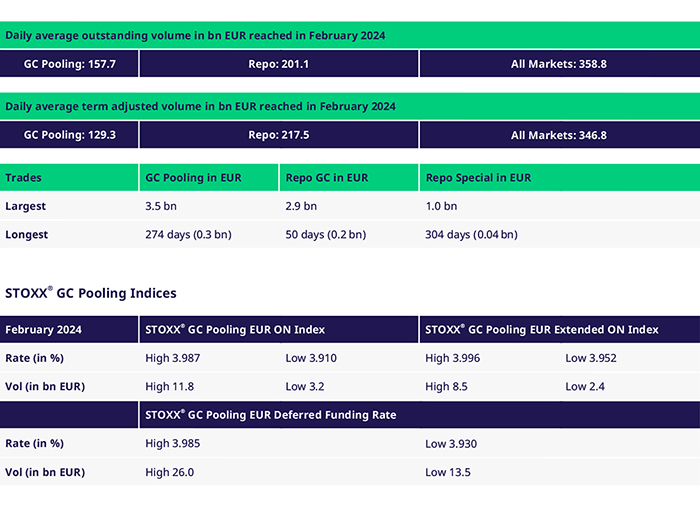

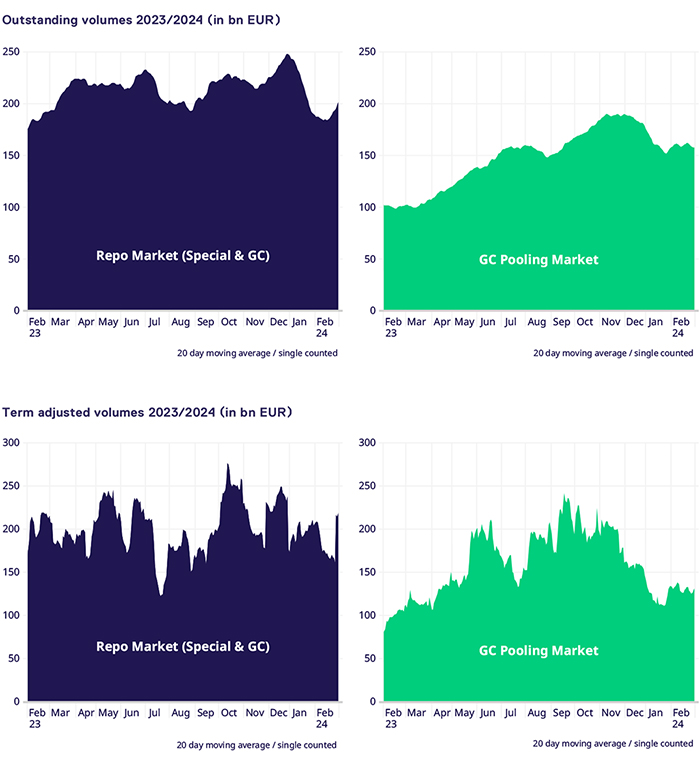

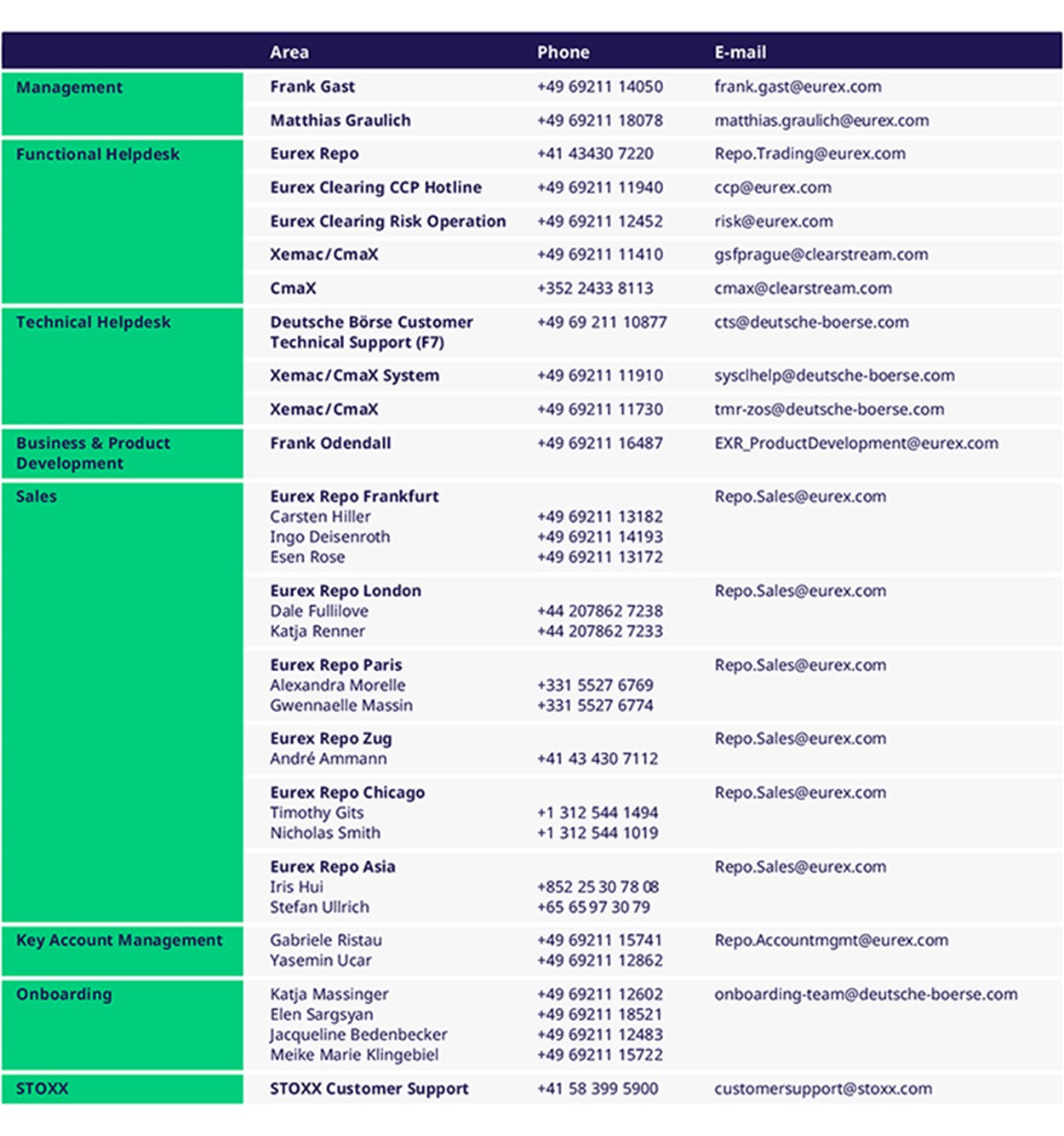

February 2024 demonstrated a consistent upward trend, with the average daily term-adjusted volume year-to-date across all Eurex Repo markets increasing by 19% compared to previous years, totaling €344 billion. This notable growth was largely driven by a 34% increase in GC Pooling and a 12% rise in the Repo Market.

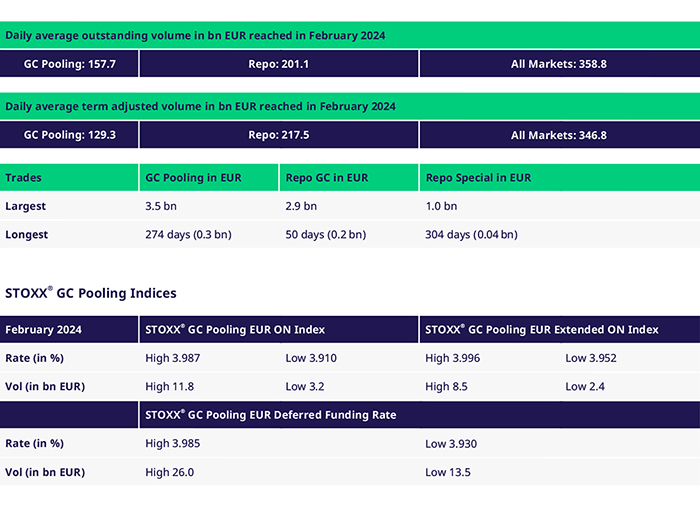

Outstanding and Traded Volumes

Comparing the average outstanding volume of Eurex Repo across all markets in February 2024 to that of February 2023, there was a noticeable increase of 22.1%. This surge was primarily attributed to a 55.4% rise in GC Pooling and a 4.5% growth in the Repo Market.

Eurex Repo's year-to-date average traded volumes remained relatively flat compared to last year. However, the GC & Special segment saw a slight increase, primarily driven by higher trading activity in French and Italian government bonds.

Spreads and Collateral

The average short-term rates in GC Pooling demonstrated stability, maintaining a spread of 1.5-3 (avg 1.74) basis points between the ECB and EXT ECB baskets overnight. This consistency was positively reflected across various terms up to one month, indicating a well-balanced and steady market condition. Notably, there was a lesser drop in the ECB GC Pooling basket overnight repo rate compared to the end of January, indicating resilience in the market.

The deferred funding rate continued to tighten, averaging -2.5 basis points against the ECB’s deposit rate, reflecting the trend of high-quality collateral becoming cheaper.

Additionally, Bund Specials repos continued to cheapen against the GC Pooling ECB basket, with the average spread narrowing from -25 bps in January to -9 bps in February.

Eurex Term Repo

Short-term liquidity in EUR GC Pooling showed a positive increase compared to January, indicating improved market conditions.

For terms ranging from one week to one month, liquidity remained dynamic with a slight upward curve, reflecting subtle market adjustments.

Notably, GC Pooling saw significant activity in standard terms exceeding nine months, particularly within the ECB Basket. This highlights growing investor interest in longer-term investments, further emphasized by the upward shift in the nine-month ECB basket average traded rate towards month-end, signaling positive market momentum.

EU Bonds and SSAs

Traded volumes in SSAs remained relatively stable, with a 35% increase in KfW bonds, while EU bonds experienced a slight decline compared to January.

Government Bonds

Bund Specials saw a decline in year-to-date trading volumes due to the recent cheapening trend of Bunds. However, February trading recovered, with daily volumes 14% higher compared to January.

In other government bonds, the positive trend of higher trading volumes continued particularly French government bonds. Increased quoting activity resulted in a 31% jump in trading volumes compared to January. Significant activity was also noticed in peripheral governments (specifically Italian government bonds), which experienced a remarkable +147% increase compared to January.

This activity was particularly evident in the GC repo format and for terms ranging from one week to three months, indicating broad market participation and interest in different maturities.

Furthermore, the number of repo transactions executed saw a significant rise in February. This was driven by increased activity in core and semi-core EUR government bonds executed via the order book.

Report

2023 was a year of transformation in the world of finance. All the trends that have shaped our industry in recent years – including the technological revolution, the sustainability agenda, and geopolitical tensions – have intensified in ways that require even greater engagement, smarter strategies, and greater agility. New risks to financial stability have also prompted regulators to reassess their existing policies. The repo market has also had its ups and downs in this remarkable year. Download the report as we discuss the challenges and successes and look at the issues which are most likely to be relevant in 2024.

Volumes

Participants

View the current Participant List Repo and GC Pooling.

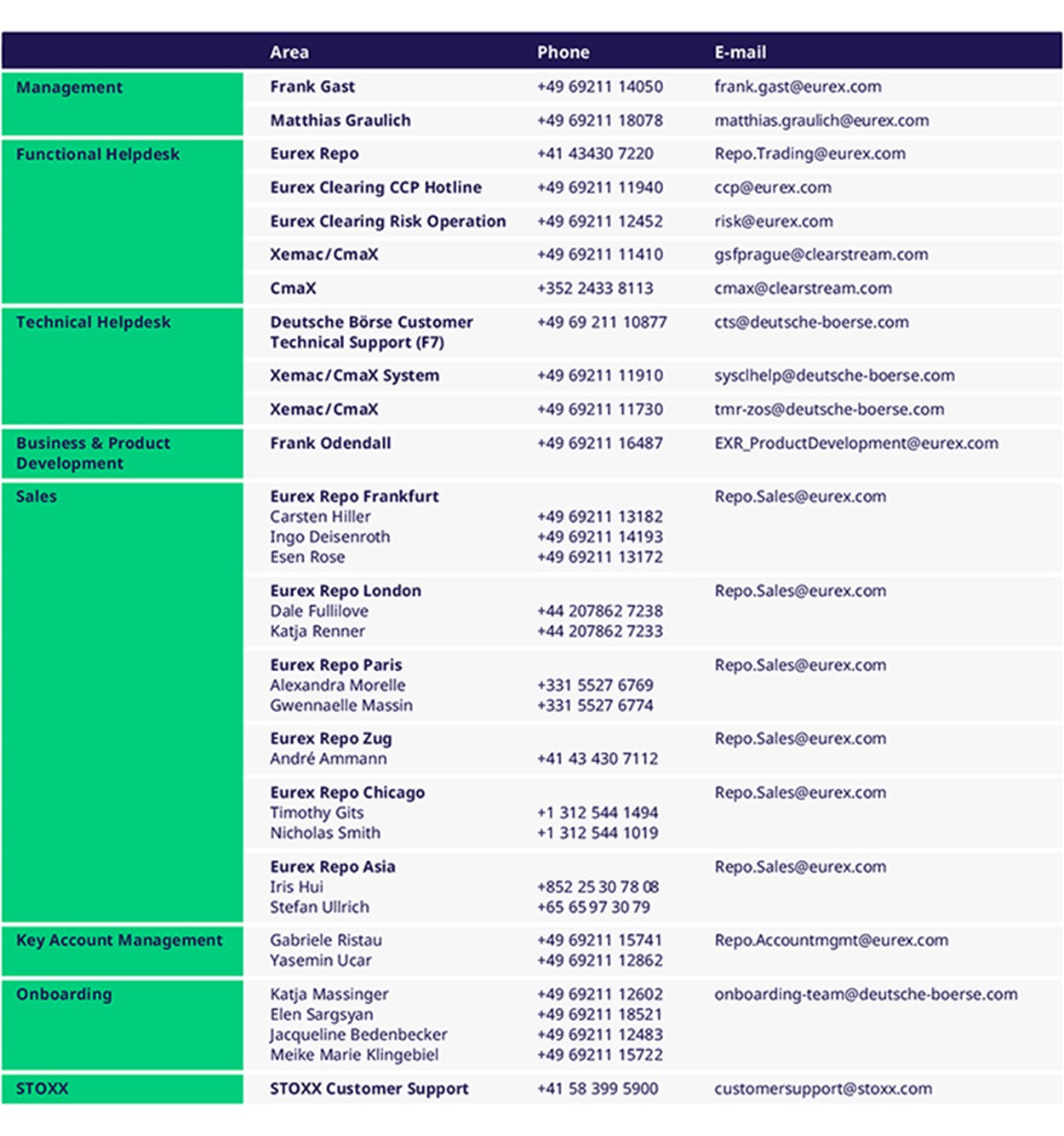

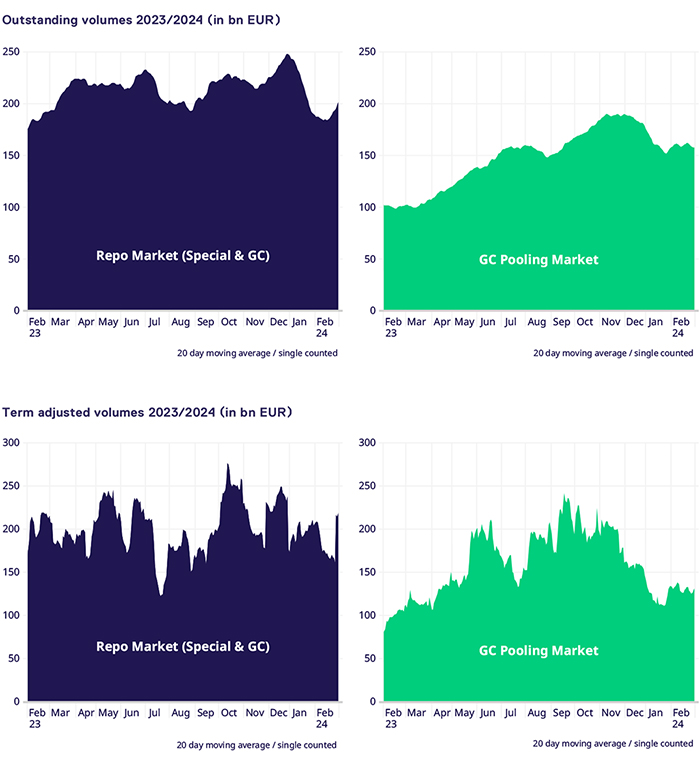

Contacts

For more information, please visit the websites of Eurex Repo and GC-pooling or contact: