Market briefing: ''December saw another strong month of volume development at Eurex Repo''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

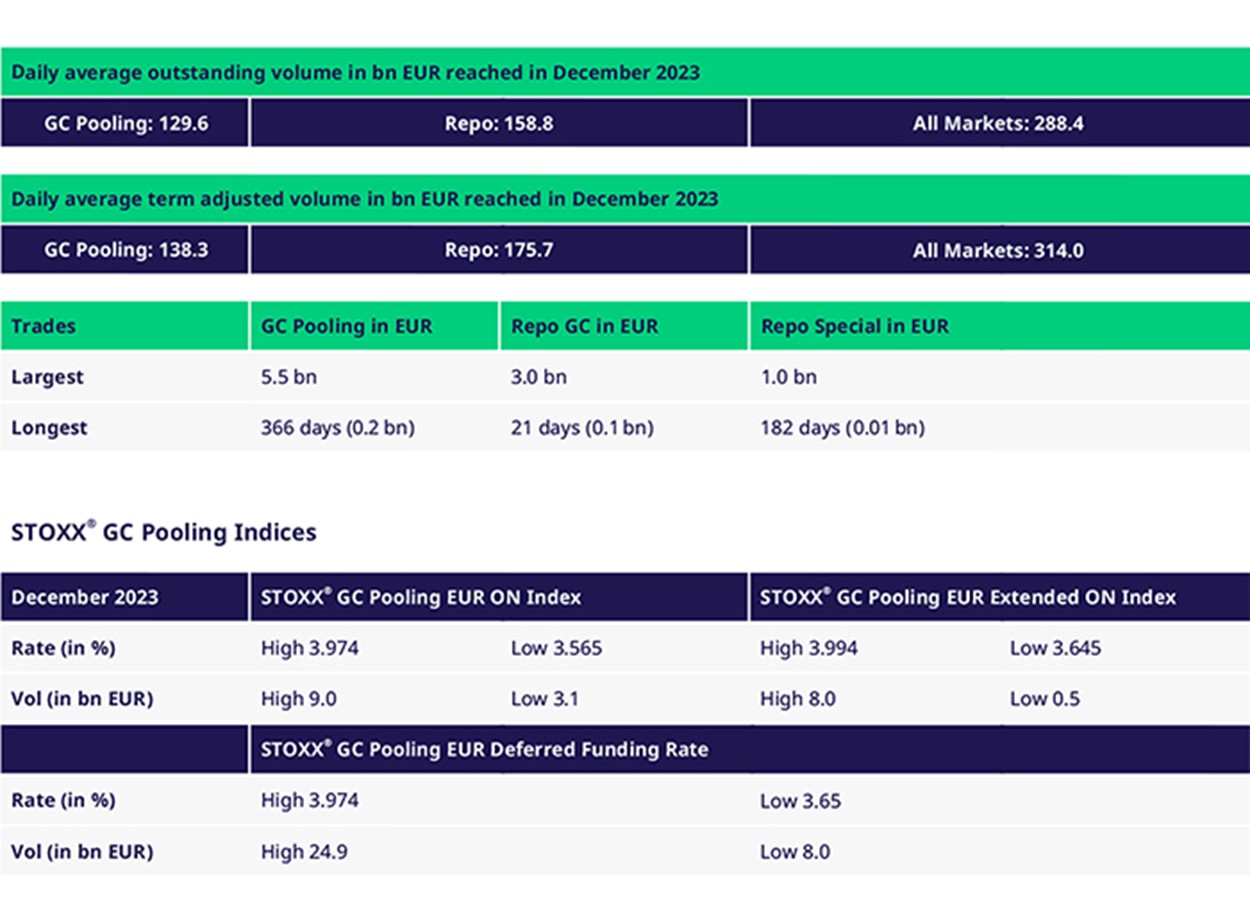

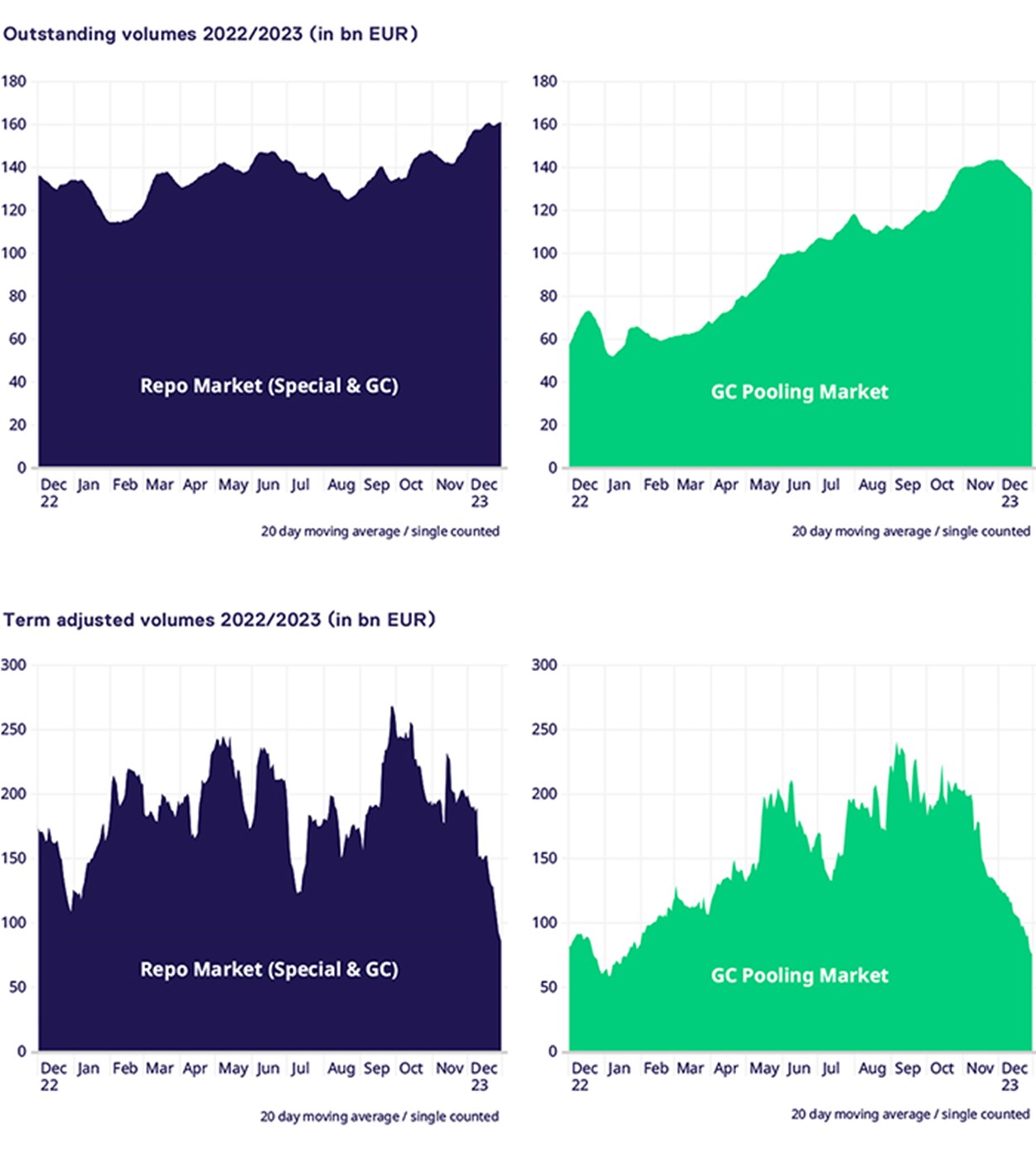

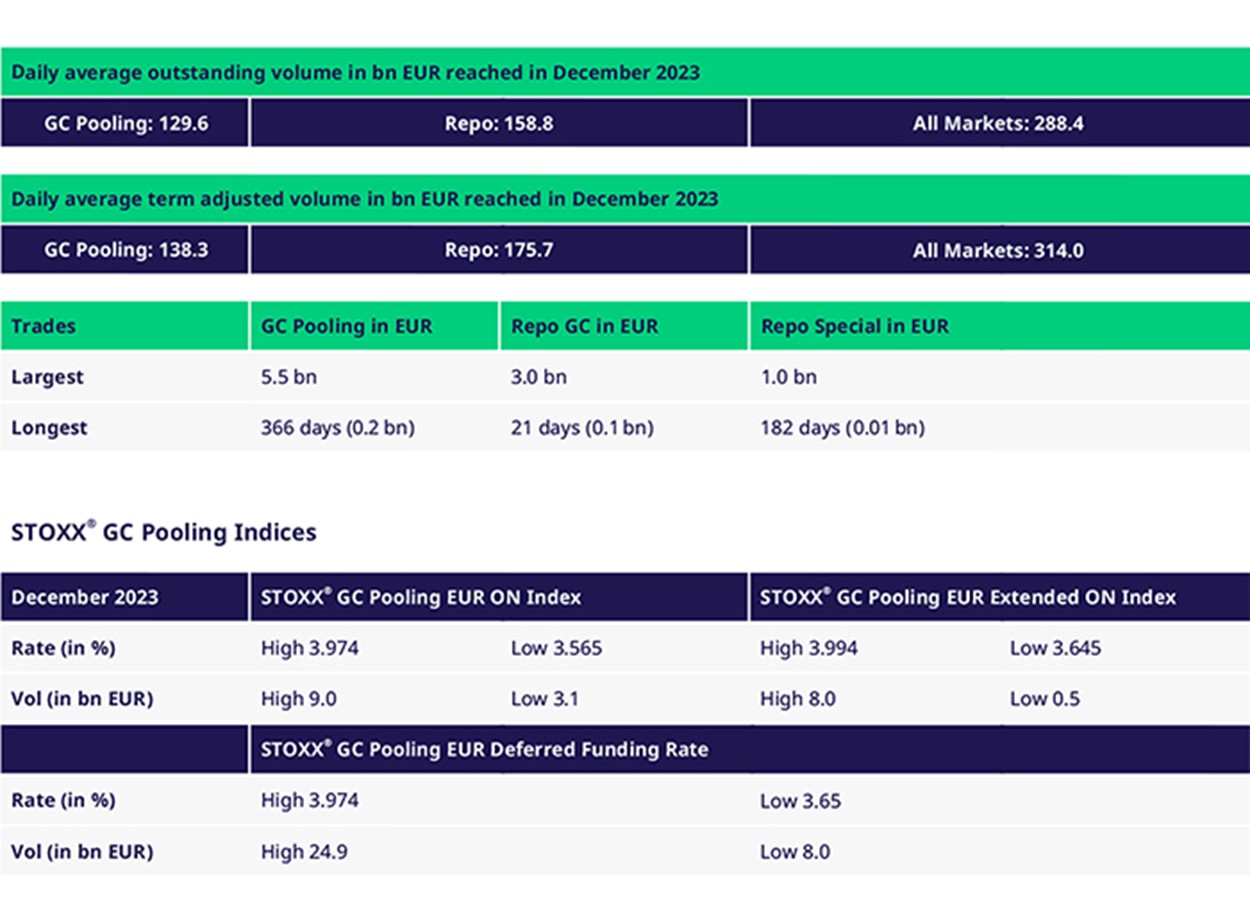

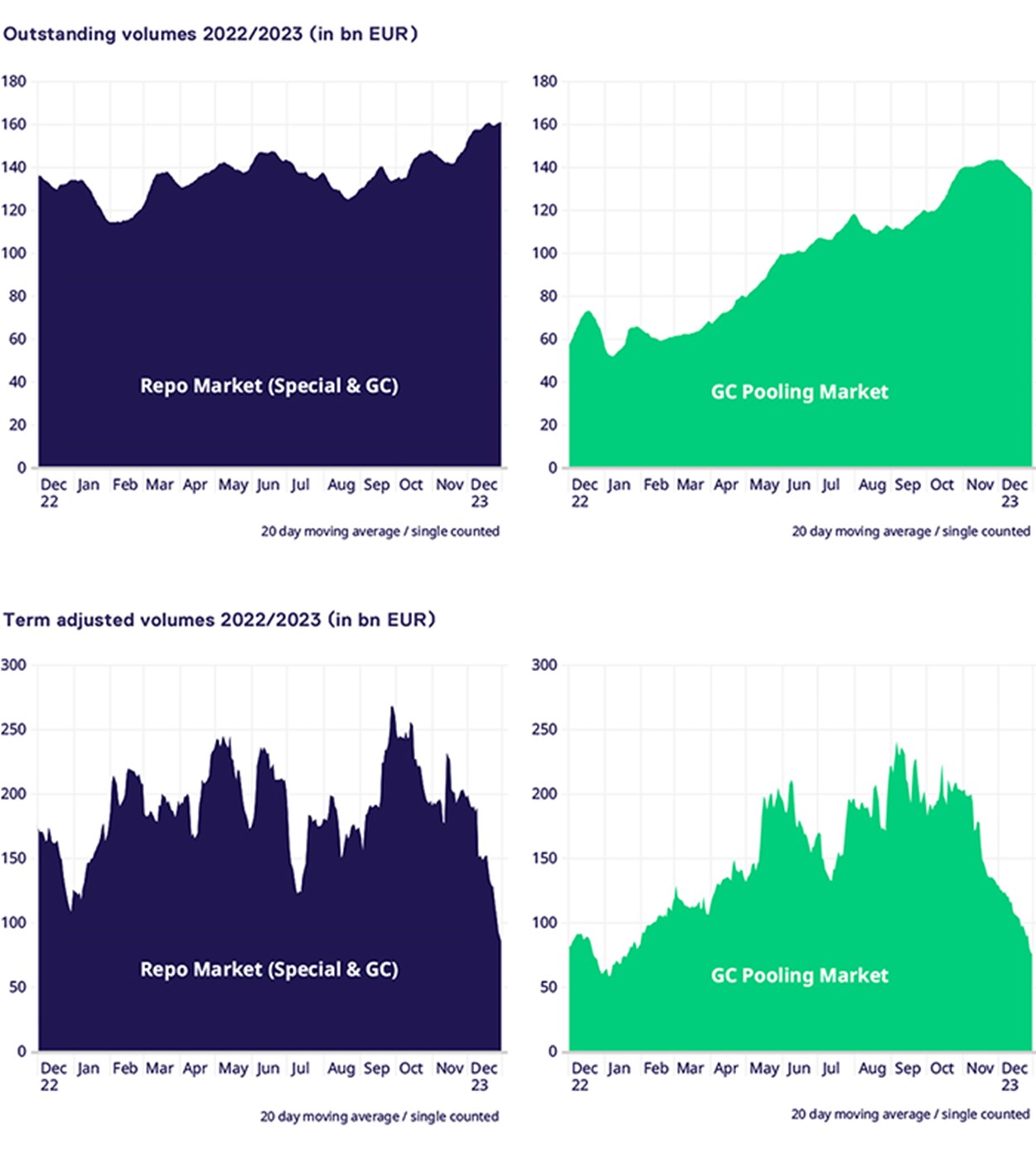

December saw another strong month of volume development at Eurex Repo with continued growth in both GC Pooling and the Repo Market segments compared to December 2022. Average daily term adjusted traded volume grew by 104.8% in GC Pooling and 57.1% in the Repo Market segment. Comparing the average term adjusted traded volume of 2023 to 2022 we can see an increase of 70.1% on Eurex Repo in total, with 141.8% growth contributed by GC Pooling and 37.5% in the Repo Market.

Comparing December to November we can see a drop in term adjusted traded volume of 22% which is attributable to some extent to seasonal reduction in the run up to year end. Performance in October and November had been so strong that Q4 2023 term adjusted traded volumes exceeded Q3 by 10% and was the highest volume quarter since 2014.

During December EUR GC Pooling sustained high volumes in one week and two-week terms particularly in the ECB basket. One day term volumes saw a small increase compared to November of around 10% with volume evenly split between ECB and EXT ECB baskets.

In the ECB basket longer term trading was again much stronger than in the EXT ECB basket with 12 months trading briskly particularly in the first half of December. As the twelve-month ESTR rate descended during early December this impacted wholesale funding markets with the twelve-month EUR ECB basket executing down to a low point of 3.53. GC Pooling executing beyond two-week terms started to become more scarce as the month progressed and the turn of year approached. In EUR GC Pooling repo rates over year end fell to around ESTR minus 40 bps at the low point.

Eurex Repo introduced our innovative trade type ‘Break dates’ during December featuring automatic pre-formatted opening and closing dates within term trades, with some initial trades successfully quoted and executed.

The INT MXQ GC Pooling basket was highly animated in terms beyond the turn with over EUR 2 billion traded volume seen in terms maturing from January to March. Outstanding volume in the INT MXQ basket was 70% higher at the end of December than at the end of November.

On the Repo Market segment the year end passed in orderly fashion with concerns about collateral scarcity having receded earlier in the autumn. In the event there was little specialism in the repo market at year end with lending spreads reported as very low. Eurogovt Specials were very busy over the turn with terms typically extending out to March, with an increasing volume of term FR govt repo executing at a spread versus ESTR.

Articles

Eurex Repo: "Paving the way for new paradigms"

The annual Global Funding and Financing (GFF) Summit is gearing up under the banner of “Paving the way for new paradigms”, amid a market dynamic that’s in stark contrast to last year. Eurex Repo’s Frank Gast, Managing Director and Member of the Management Board, and Carsten Hiller, Head of Repo Sales Europe, explain how we got here and what the road ahead looks like.

SFT Summit Edition: "Securities finance in times of monetary transitions"

Clearstream’s Marton Szigeti and Eurex Repo’s Frank Gast speak to Bob Currie about how monetary readjustment, and changes in regulation and operational culture, are reshaping user engagement in securities lending and cleared repo markets.

Report

2023 was a year of transformation in the world of finance. All the trends that have shaped our industry in recent years – including the technological revolution, the sustainability agenda, and geopolitical tensions – have intensified in ways that require even greater engagement, smarter strategies, and greater agility. New risks to financial stability have also prompted regulators to reassess their existing policies. The repo market has also had its ups and downs in this remarkable year. Download the report as we discuss the challenges and successes and look at the issues which are most likely to be relevant in 2024.

New podcast - stay connected

Financial Bite: Projecting European repo levels and volumes for 2024.

Eurex’s Carsten Hiller, and Christoph Rieger from Commerzbank join the Financial Bite to discuss the latest developments in the Repo Market and what to expect in 2024.

Listen now

Industry events

Last chance to register: GFF Summit 2024 | 30 January - 1 February

We are thrilled to announce that the Global Funding and Financing (GFF) Summit will be back on 30 January to 1 February 2024 in the European Convention Center in Luxembourg. Make sure to save the date and mark your calendar already today. Can’t wait? Follow #GFFSummit on LinkedIn to stay up to date and to have a look at our past events or tune in to the GFF podcast, available on all your favorite streaming platforms.

We look forward to seeing you in Luxembourg!

Volumes

Participants

We welcome the following new clients who have been admitted to Eurex Repo Markets in December 2023:

- ING Bank Slaski S.A., Warswaw, Poland, 18.12.2023

- Citadel Securities Services Ireland, Dublin, Ireland, 29.12.20223

View the current Participant List Repo and GC Pooling.

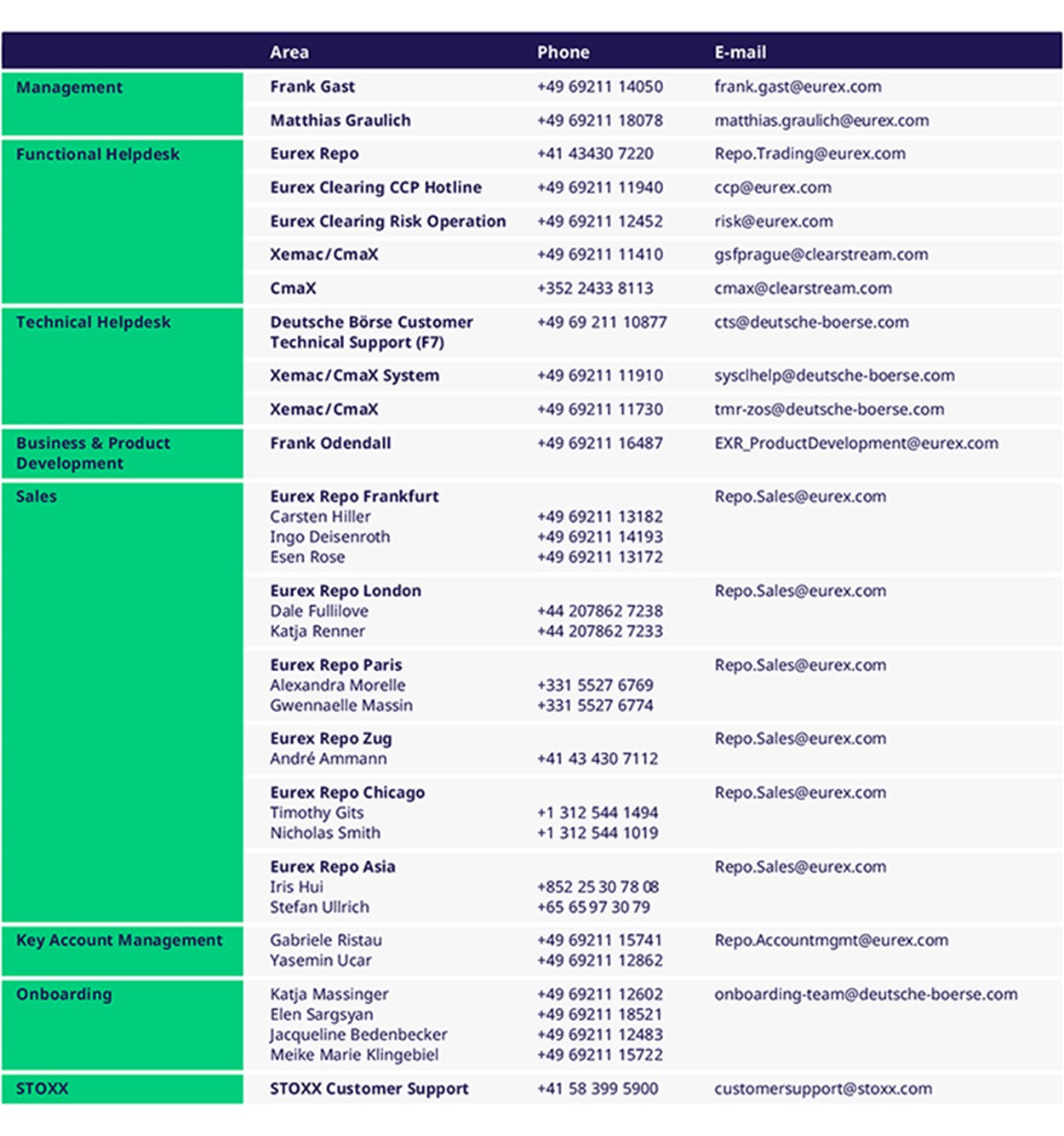

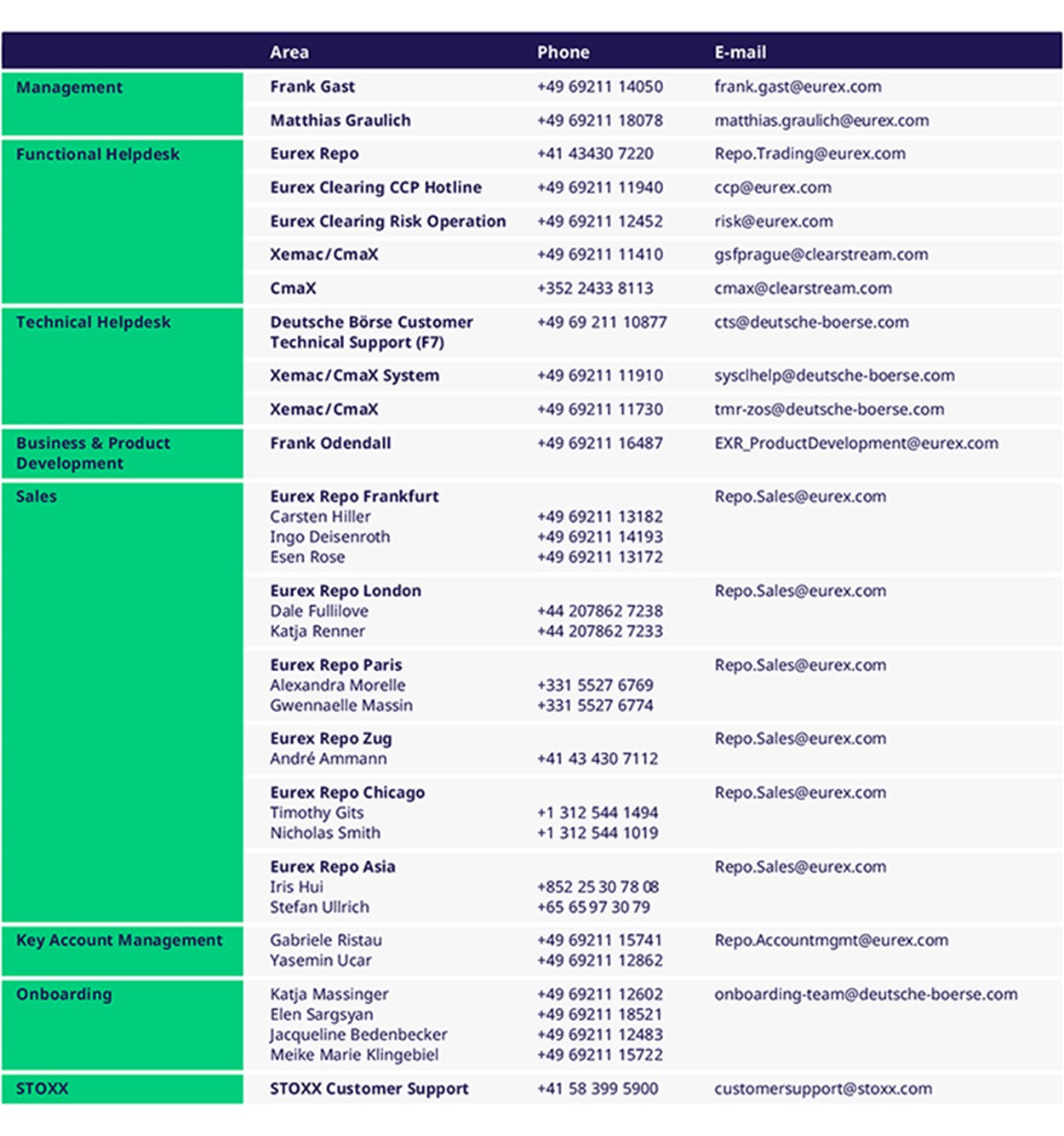

Contacts

For more information, please visit the websites of Eurex Repo and GC-pooling or contact: