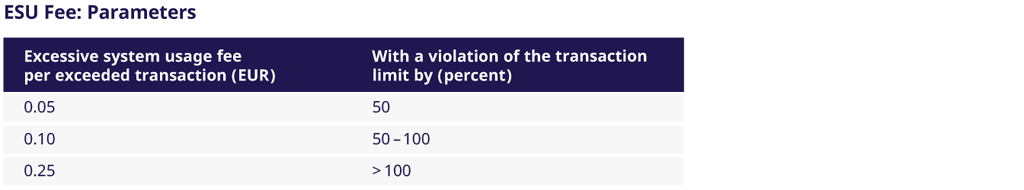

The ESU Fee is calculated using the following equation:

ESU Fee = [ (number of transactions) - (transaction limit) ] * fee

A transaction is defined as a system message that reaches the matching engine and yields a response. Such a transaction can be identified by inspecting the system response. If the response contains a time stamp from the matching engine the message is added to the daily transaction count of the Participant for the respective product.

The transaction limit is comprised of two components:

- A volume component, which is calculated by multiplying the volume in the order book by a predefined volume factor, and

- a floor, which is set for each Participant regardless of any traded volume in the order book. A Market Maker can receive a higher floor, depending on its Market-Making performance.

Please find below a concept paper describing the calculation (including an example) in detail.